Consumer Sentiment Sinks on Recession Fears

April 11, 2025

In a stark shift reflecting growing economic unease, consumer sentiment in the United States has plunged to its lowest level in months, driven by mounting fears of a potential recession. According to the latest data from the University of Michigan’s Consumer Sentiment Index, confidence dropped sharply in April, underscoring heightened anxiety over inflation, interest rates, and job market uncertainty.

A Downward Trend

The preliminary reading of the Consumer Sentiment Index for April fell to 62.5 from March’s 76.0, marking one of the steepest monthly declines in recent years. Analysts point to a cocktail of economic pressures weighing heavily on American households. Despite cooling inflation compared to last year’s peak, persistent high prices, especially in food and housing, continue to erode purchasing power.

“Consumers are increasingly worried about the future of the economy,” said Joanne Parker, a senior economist at MarketView Analytics. “We’re seeing a shift from inflation-related concerns to broader fears about job security and economic slowdown.”

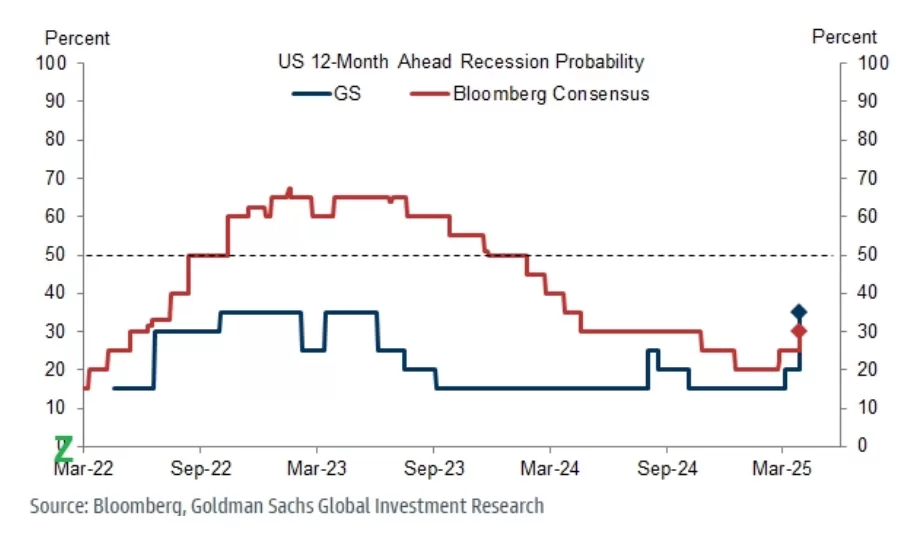

The Recession Question

Speculation over a looming recession has intensified amid recent signals from the Federal Reserve suggesting it may hold interest rates higher for longer to ensure inflation remains in check. While the U.S. economy has shown resilience in some areas—such as continued, albeit slowing, job growth—warning signs are starting to flash.

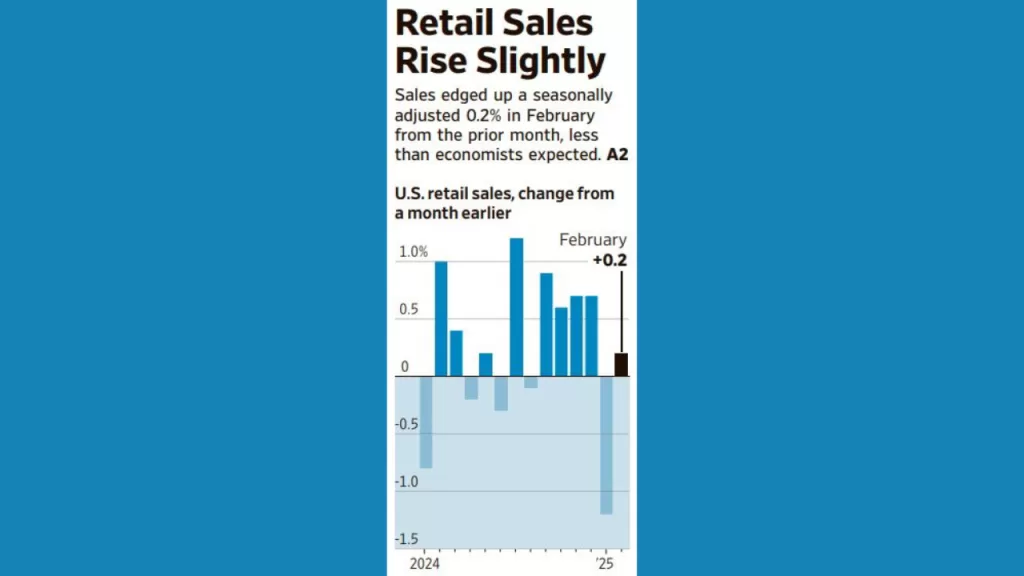

Business investment has shown signs of softening, consumer spending growth is decelerating, and major retailers have issued cautious outlooks for the rest of the year. Additionally, the yield curve remains inverted, a historically reliable recession indicator.

“The data isn’t pointing to an immediate crash,” said Lisa Trent, a financial analyst at Beacon Economics, “but it does suggest that people are feeling more uncertain about their financial future than they were just a few months ago.”

Personal Finances Under Pressure

The sentiment drop also reflects growing unease at the individual level. Credit card debt has reached record highs, and savings rates remain low compared to pre-pandemic levels. While wages have increased, they have not kept pace with the cost of living in many regions, compounding the sense of financial strain.

A growing number of consumers are reporting that they expect their financial situation to worsen in the coming year, reversing a trend of cautious optimism that had emerged in late 2023 as inflation began to ease.

Markets React

Stock markets dipped following the release of the sentiment report, with investors interpreting the data as a potential sign of softening demand and economic contraction ahead. The S&P 500 and Nasdaq both fell more than 1% in morning trading, while bond yields declined on expectations that the Fed might need to pivot sooner than expected if the economy weakens.

Looking Ahead

Whether or not a full-blown recession materializes, the current mood of the consumer—who makes up roughly two-thirds of the U.S. economy—is a crucial indicator of what’s to come. A sustained drop in sentiment could translate into reduced spending, lower business revenues, and eventually, slower economic growth.

For now, policymakers and business leaders are closely watching the data, hoping to navigate a narrow path between curbing inflation and avoiding a hard landing.

“The next few months will be critical,” said Parker. “If the public loses confidence in the economy, that sentiment alone can become a self-fulfilling prophecy.”

Contact Factoring Specialist, Chris Lehnes