What to Do If You Realize You Made a Mistake on Your Tax Return After Filing

Discovering an error on your tax return after filing can be a source of stress and concern. Whether it’s a simple math mistake or a more significant oversight, rectifying the error promptly is crucial to avoid potential penalties and ensure accurate tax compliance. In this article, we outline steps to take if you realize you made a mistake on your tax return after filing, offering guidance on how to correct the error and minimize its impact on your tax situation.

1. Assess the Nature and Impact of the Mistake:

Before taking corrective action, carefully review your tax return to identify the nature and scope of the mistake. Determine whether the error is minor or significant and assess its potential impact on your tax liability. Common mistakes include errors in reporting income, deductions, credits, and filing status, as well as mathematical errors or missing information. Understanding the nature of the mistake will help guide your approach to correcting it.

2. File an Amended Tax Return:

If you discover an error on your tax return after filing, you may need to file an amended tax return to correct the mistake. The IRS allows taxpayers to file Form 1040-X, Amended U.S. Individual Income Tax Return, to amend a previously filed tax return. Be sure to complete the amended return accurately, including all necessary corrections and explanations for the changes. Attach any supporting documentation, such as additional forms or schedules, to substantiate the corrections.

3. Pay Any Additional Taxes Owed:

If the error results in an increase in your tax liability, be prepared to pay any additional taxes owed along with your amended tax return. Include payment for the additional taxes owed with your amended return to avoid interest and penalties for late payment. If you are unable to pay the full amount owed, consider exploring payment options such as installment agreements or requesting an offer in compromise from the IRS.

4. Be Proactive and Transparent:

When filing an amended tax return, it’s essential to be proactive and transparent in addressing the error with the IRS. Provide clear and concise explanations for the corrections made on your amended return and communicate any mitigating circumstances that may have contributed to the mistake. Being forthcoming and cooperative can help expedite the processing of your amended return and minimize the risk of further scrutiny from the IRS.

5. Take Steps to Prevent Future Errors:

Once you’ve corrected the mistake on your tax return, take proactive steps to prevent similar errors in the future. Implementing robust recordkeeping practices, using tax preparation software or hiring a qualified tax professional, and staying informed about tax law changes can help reduce the likelihood of errors on future tax returns. Regularly review your tax documents and seek guidance if you have any questions or concerns about your tax situation.

Conclusion:

Discovering a mistake on your tax return after filing can be a daunting experience, but it’s essential to address the error promptly and proactively. By filing an amended tax return, paying any additional taxes owed, and communicating openly with the IRS, you can correct the mistake and minimize its impact on your tax situation. Taking steps to prevent future errors and staying vigilant about your tax compliance will help ensure accurate and timely tax filings in the future.

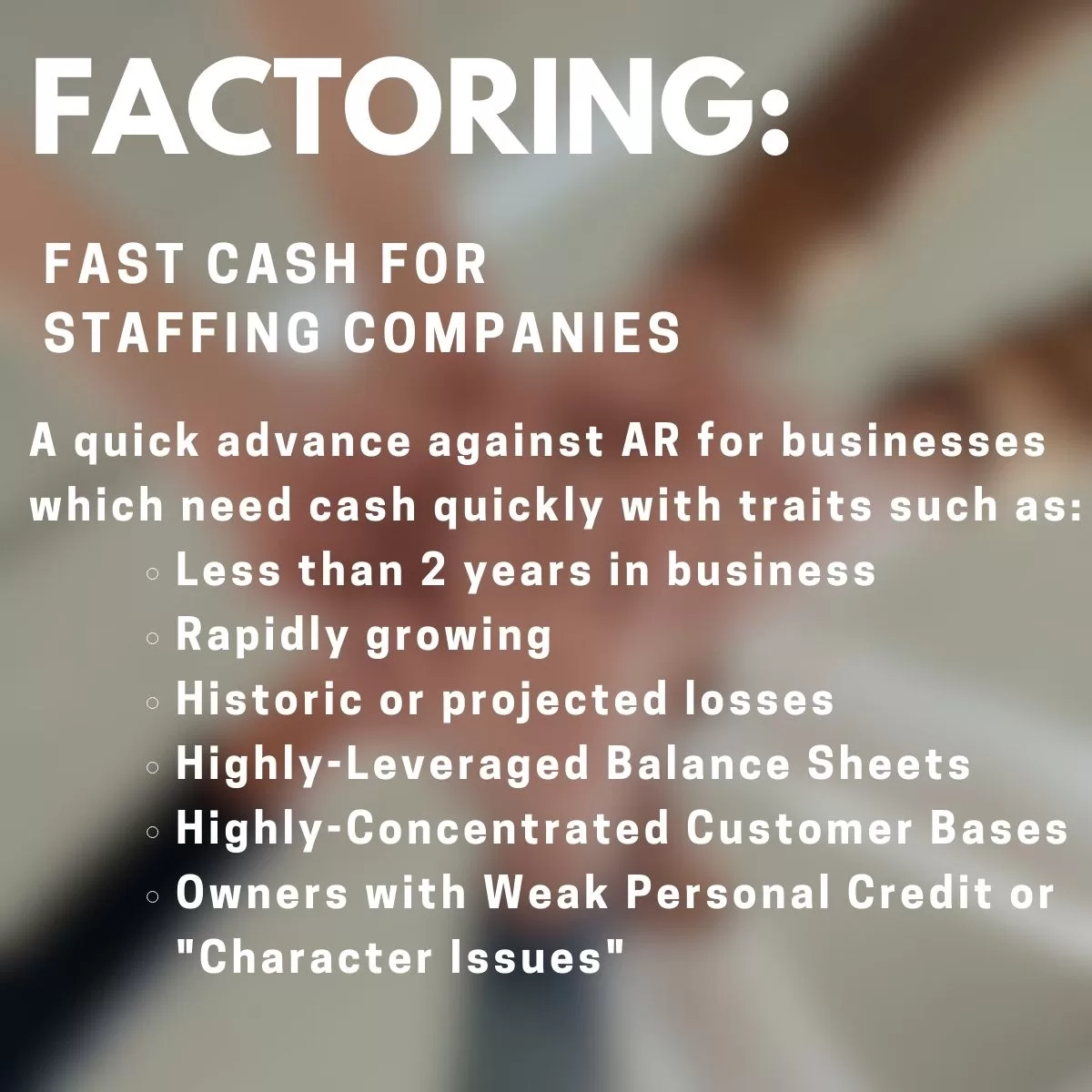

Learn more about accounts receivable factoring

Connect with Factoring Specialist, Chris Lehnes on LinkedIn