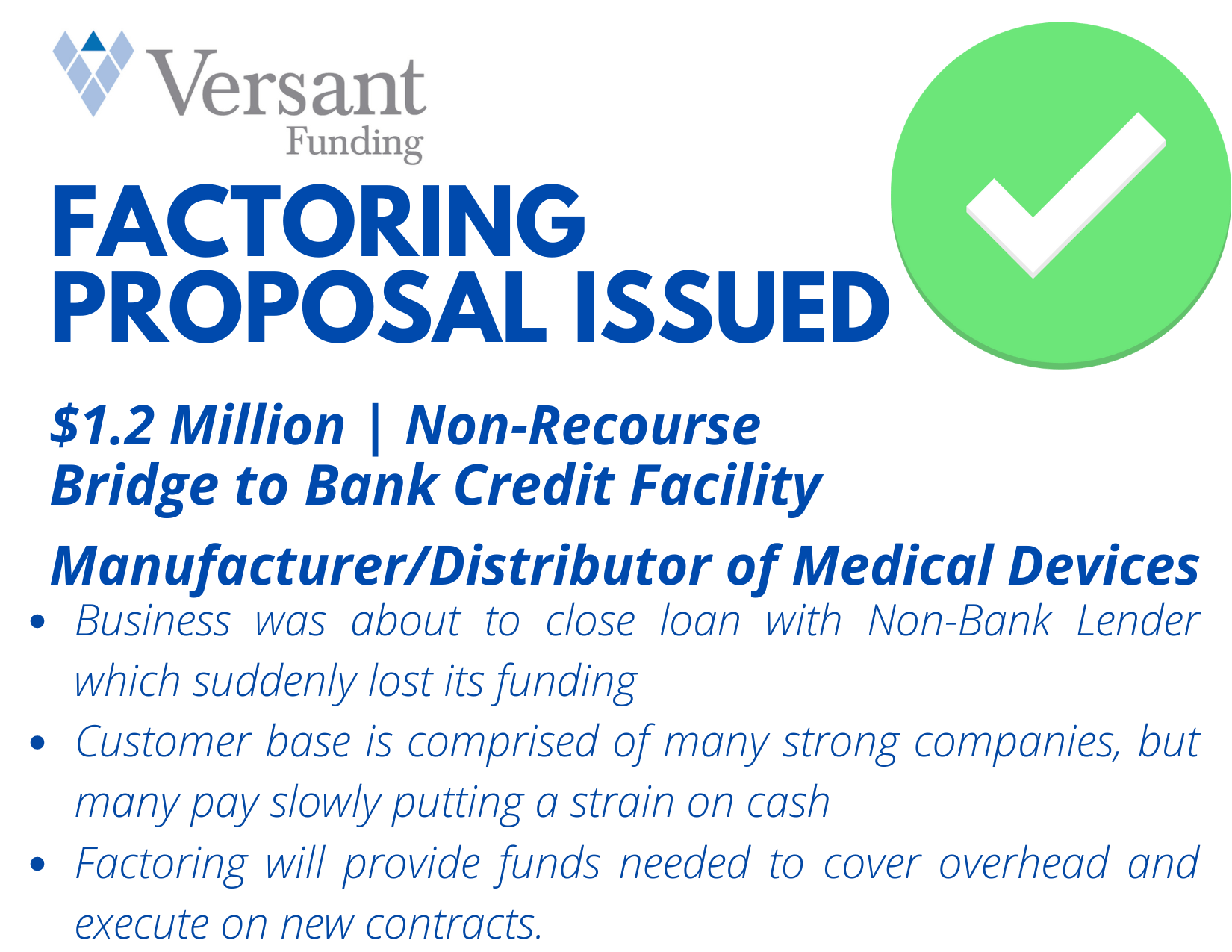

Factoring Proposal Issued – $1 Million – Non-Recourse – SaaS

The future of Software as a Service looks promising and dynamic, with several key trends expected to shape the industry in 2024 and beyond.

Key Trends in SaaS:

- Vertical : Vertical solutions, tailored to specific industries such as healthcare, finance, and hospitality, are on the rise. These specialized services offer more precise solutions and better integration with industry-specific tools, providing higher returns on investment by addressing niche market needs more effectively

- Low-Code/No-Code Platforms: The adoption of low-code and no-code platforms is revolutionizing SaaS development. These platforms enable users, even those without technical expertise, to build applications through visual interfaces. This democratizes app development, speeds up the process, and reduces costs. It’s anticipated that by 2024, a significant portion of new apps will be created using these platforms

- AI and Machine Learning Integration: AI is becoming deeply embedded in SaaS, enhancing capabilities such as personalization, predictive analytics, and automation. AI-driven tools can analyze vast amounts of data to provide actionable insights, improve customer interactions, and streamline operations. Generative AI, like the features seen in tools like Canva and Salesforce’s Einstein Copilot, is expected to become more prevalent

- Micro-SaaS: Micro refers to small-scale solutions that target very specific needs. These lightweight, modular applications are gaining traction for their flexibility and ease of integration into existing systems. They offer tailored solutions for niche markets, often developed by small teams or individual entrepreneurs

- Consumption-Based Pricing Models: More companies are shifting towards consumption-based pricing models, where customers pay based on their actual usage rather than a fixed subscription fee. This model is particularly appealing for businesses looking to optimize costs and align spending with usage (Exploding Topics) (RIB Software).

- Integration Platform as a Service (iPaaS): iPaaS solutions are becoming essential for connecting disparate applications and systems within organizations. These platforms facilitate seamless data flow and integration across multiple tools, enhancing operational efficiency and reducing the complexity of managing integrations manually (Exploding Topics).

- Enhanced Security and Compliance: With the growing reliance on SaaS, security and compliance have become critical. SaaS providers are investing heavily in cybersecurity measures and ensuring compliance with various regulations like GDPR and HIPAA to protect user data and maintain trust (Bombay Softwares) (SaaSworthy).

- Blockchain Technology: Blockchain is starting to impact particularly in terms of security and transaction transparency. Its decentralized nature can enhance data security and integrity, making it a valuable addition to SaaS platforms (SaaSworthy).

Strategic Tips :

To thrive in this evolving landscape, SaaS companies should:

- Embrace Agility: Stay adaptable to market changes and technological advancements.

- Invest in Cybersecurity: Protect sensitive data with robust security measures.

- Prioritize Customer Experience: Focus on user-friendly interfaces and excellent support.

- Leverage Data: Use data analytics for better decision-making and personalization.

- Form Strate

The industry is set for significant growth, driven by these innovative trends and strategic shifts. Companies that stay ahead of these developments will be well-positioned to capitalize on the expanding market opportunities.

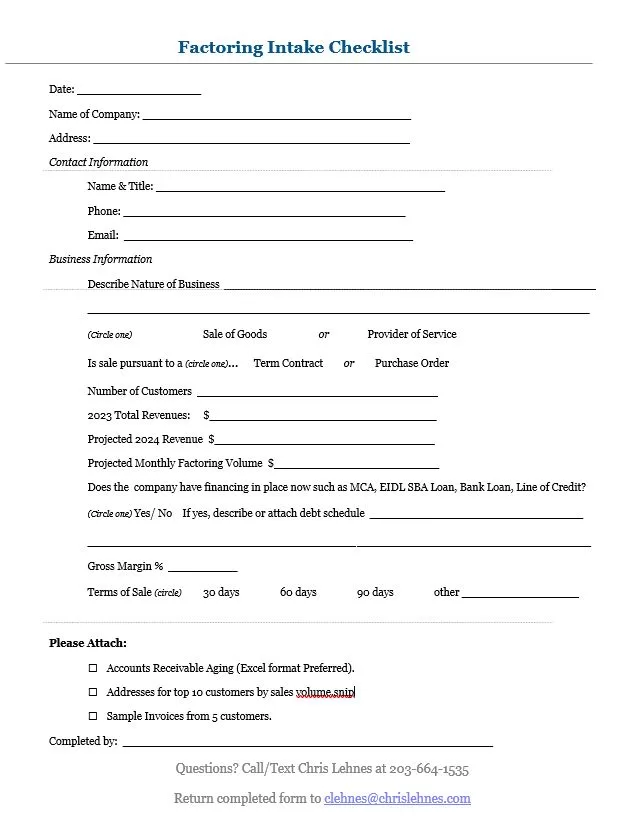

Connect with Factoring Specialist Chris Lehnes on LinkedIn