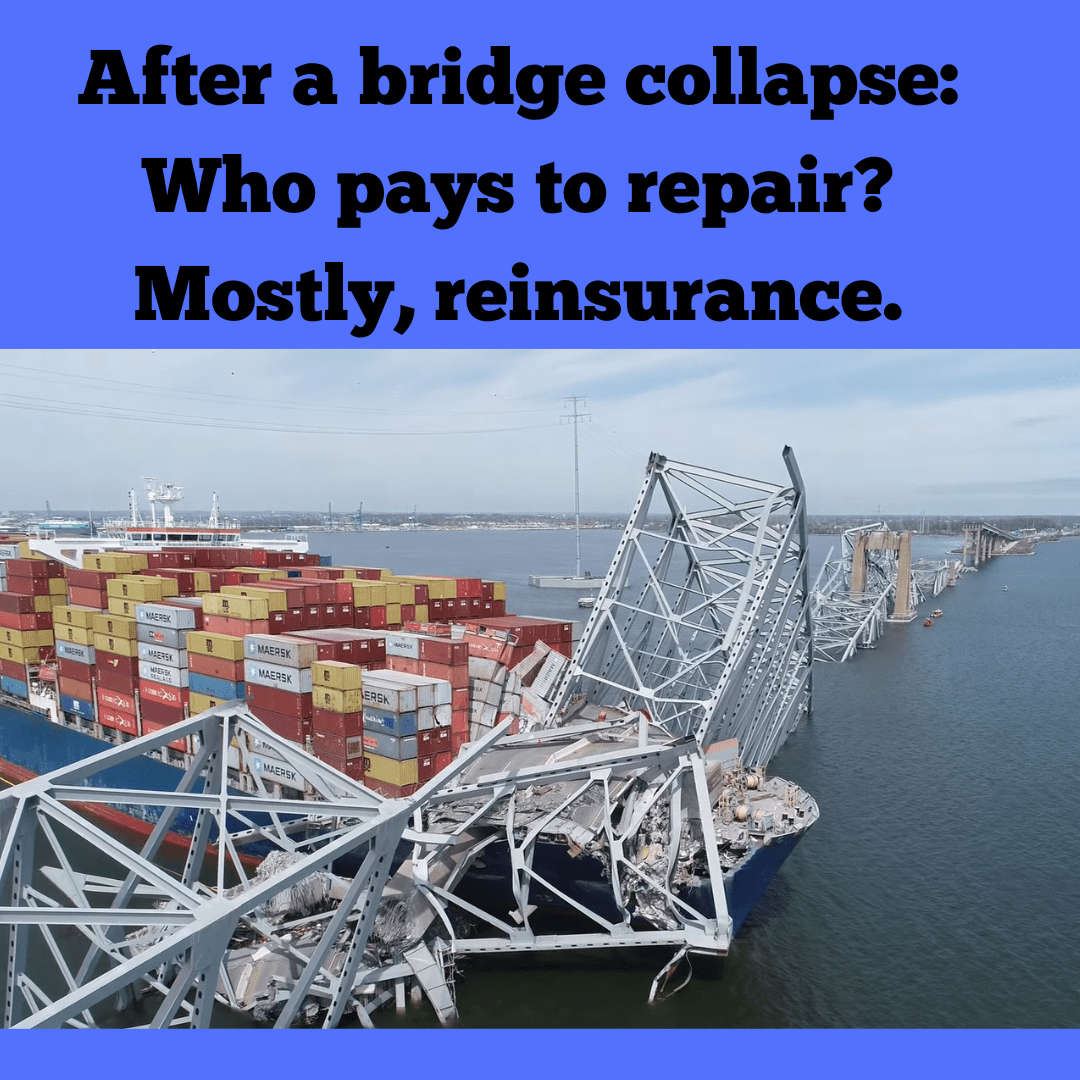

The Francis Scott Key Bridge, an iconic landmark spanning the Patapsco River in Baltimore, Maryland, stands as a testament to engineering prowess and historical significance. After a bridge collapse: Who pays to repair? Mostly, Reinsurance. However, like any infrastructure, the bridge is subject to wear and tear, requiring periodic maintenance and repairs to ensure its safety and functionality. In the event of unforeseen damage, such as structural defects or natural disasters, the financial burden of repairing the bridge can be substantial. Enter reinsurance, a critical financial instrument that can play a pivotal role in covering the costs of such repairs. So, how does reinsurance come into play in funding the repair costs of the Francis Scott Key Bridge?

Understanding Reinsurance:

Reinsurance is a risk management strategy employed by insurance companies to mitigate their exposure to large or catastrophic losses. In essence, reinsurers assume a portion of the risk assumed by primary insurers in exchange for a premium. By spreading risk across multiple parties, reinsurers help ensure that insurers remain financially solvent and capable of fulfilling their policyholder obligations, even in the face of significant claims.

Insuring Infrastructure Assets:

Infrastructure assets, such as bridges, roads, and tunnels, represent substantial investments for governments and private entities alike. Given the inherent risks associated with these assets, including exposure to natural disasters, accidents, and deterioration over time, insuring them against potential damage is crucial. Insurance policies covering infrastructure assets typically include provisions for repairs and replacement in the event of covered perils.

Reinsurance Coverage for Infrastructure Projects:

Reinsurance plays a vital role in providing coverage for infrastructure projects, including bridges like the Francis Scott Key Bridge. Insurers that underwrite policies for infrastructure assets may seek reinsurance to protect themselves against the financial ramifications of large-scale losses. In the event of damage to the bridge requiring extensive repairs, the primary insurer can turn to its reinsurers to help shoulder the financial burden, thereby ensuring that the necessary funds are available to restore the structure to its previous condition.

Financial Resilience and Risk Management:

For infrastructure owners and operators, reinsurance offers a means of enhancing financial resilience and managing risk effectively. By transferring a portion of the risk to reinsurers, infrastructure stakeholders can safeguard their financial interests and mitigate the potential impact of unforeseen events. This allows them to allocate resources more efficiently and focus on maintaining and improving critical infrastructure assets without undue financial strain.

Conclusion:

The Francis Scott Key Bridge, like many infrastructure projects around the world, relies on a combination of insurance and reinsurance to mitigate risk and ensure financial stability. In the event of damage requiring repairs, reinsurance plays a crucial role in providing the necessary funds to cover the costs. By understanding the role of reinsurance in insuring infrastructure assets, stakeholders can better protect their investments and uphold the integrity of essential structures for the benefit of society as a whole.

Learn about accounts receivable factoring