JP Morgan Chair, Jamie Dimon Suggests a Recession Is Likely to Result from Trump Trade Policies

April 9, 2025

In a candid assessment of the global economic landscape, JP Morgan Chase Chairman and CEO Jamie Dimon warned that a recession could be on the horizon, triggered in large part by increasingly aggressive trade policies. Speaking at a financial forum earlier this week, Dimon pointed to rising protectionism, tariff wars, and strained international trade relations as potential catalysts for a slowdown in global economic growth.

Trade Tensions Take Center Stage

Jamie Dimon, known for his frank evaluations of market conditions, expressed concern that many governments—particularly those of major economies—are leaning into short-term, politically motivated trade strategies at the expense of long-term economic stability. “When you close borders to trade, increase tariffs, and engage in retaliatory economic measures, it eventually comes home to roost,” Dimon said.

He referenced recent escalations in U.S.-China trade friction, ongoing disputes with European trade blocs, and emerging restrictions on technology and data flows. These policies, he suggested, are already undermining global supply chains, stifling investment, and injecting uncertainty into the corporate decision-making process.

Implications for the U.S. and Global Economy

Dimon warned that such trade fragmentation could weigh heavily on both developed and developing economies. “If these trends continue unchecked, we’re looking at a real risk of recession—not just in the U.S., but globally,” he cautioned.

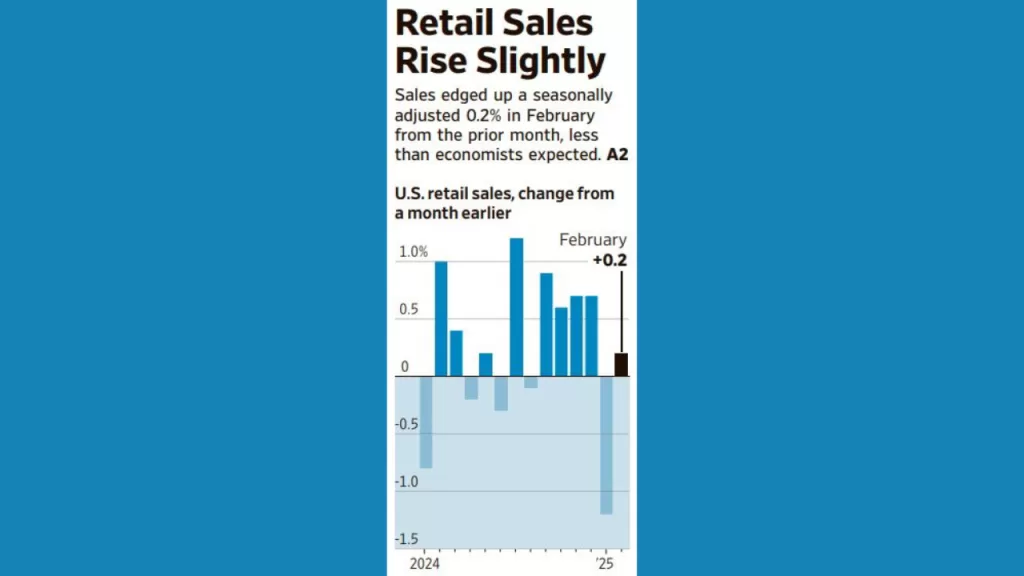

The JP Morgan chief pointed to slowing GDP growth in key markets and declining global trade volumes as early warning signs. He also highlighted how businesses are being forced to navigate increasingly complex regulatory environments and rising input costs, all of which could translate into weaker consumer demand and higher inflation.

Calls for Strategic Recalibration

Dimon urged policymakers to reassess the direction of their trade agendas. “Strategic competition doesn’t have to mean economic isolation,” he said, advocating for a more collaborative approach that balances national interests with the need for open and predictable global markets.

He also noted that the private sector can play a role in mitigating the risks, calling on multinational companies to diversify supply chains, invest in trade-resilient strategies, and push for diplomatic engagement between economic powers.

Outlook: Uncertain but Not Hopeless

While Dimon’s comments struck a cautionary tone, he remained optimistic about the potential for a course correction. “We’ve been here before. The world has a way of finding equilibrium, especially when economic consequences become too steep to ignore.”

Nonetheless, his message was clear: the world’s leading economies must tread carefully. Missteps in trade policy, particularly in today’s interconnected world, carry the weight not just of political fallout—but of a full-fledged economic downturn.

As central banks continue to monitor inflation and labor markets, all eyes will also be on the policy decisions coming out of Washington, Beijing, Brussels, and other major capitals—decisions that, as Dimon underscored, may well determine whether a recession is a near inevitability or a risk that can still be averted.