Dockworkers are a critical component of the U.S. economy, especially as they manage the flow of goods through the nation’s ports. The major ports, such as Los Angeles, Long Beach, and New York/New Jersey, handle a significant portion of international trade. A strike by dockworkers—whether due to labor disputes over wages, working conditions, or automation—can have far-reaching effects on the economy, businesses, and consumers. This article explores how a dockworkers strike could impact various sectors of the U.S. economy

1. Disruption of Supply Chains

One of the most immediate and severe consequences of a dockworkers strike is the disruption of supply chains. U.S. ports are critical hubs for imports and exports. When dockworkers stop handling cargo, goods are left stranded at ports, leading to significant delays.

- Imports: Many industries in the U.S. rely heavily on imports, from electronics and consumer goods to raw materials for manufacturing. A prolonged strike would slow down or even halt the supply of these products, leading to shortages. Retailers could face empty shelves, particularly during peak shopping seasons, such as the holidays, which could lower consumer confidence and reduce spending.

- Exports: U.S. exporters, including agriculture and manufacturing sectors, would also feel the sting. Agricultural products, in particular, are time-sensitive. Delays in shipping can lead to spoilage, a loss of market share abroad, and lower revenues for U.S. farmers and exporters.

2. Increased Costs for Businesses and Consumers

As the flow of goods is disrupted, the economic principle of supply and demand kicks in, leading to higher costs for businesses and consumers. Here’s how:

- Businesses: Companies that rely on imports for manufacturing or retail could see their costs rise due to the need to find alternative supply chain routes, pay for expedited shipping, or source from domestic suppliers at higher costs. Manufacturers could face production slowdowns or shutdowns if they cannot get necessary components on time.

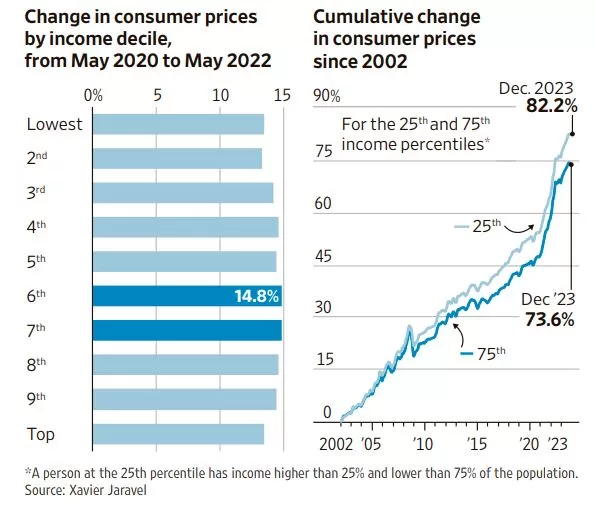

- Consumers: These increased costs are often passed on to consumers in the form of higher prices for goods, especially for imported items like electronics, clothing, and toys. Inflation could rise temporarily due to these increased supply chain costs, further straining household budgets.

3. Economic Losses in Port Cities

The economic impact of a dockworkers strike is particularly acute in port cities, where the local economy is heavily reliant on port operations. Ports generate revenue for local governments through taxes, and they create thousands of direct and indirect jobs, from truck drivers to warehouse workers. When ports are closed or operating at reduced capacity, these workers face layoffs or reduced hours, leading to a reduction in local consumer spending and tax revenues.

4. Impact on National GDP

Ports play an essential role in the broader U.S. economy. A strike that disrupts the flow of international trade can negatively affect the national GDP. Reduced imports and exports mean lower economic activity, particularly in industries reliant on global supply chains. The longer a strike lasts, the more significant the hit to national economic growth. For example, during the 2002 West Coast dockworkers strike, the U.S. economy reportedly lost billions of dollars per day, showcasing the magnitude of such disruptions.

5. Global Trade Relations

A prolonged strike at U.S. ports can also strain relationships with global trading partners. Many countries depend on access to the U.S. market for their exports, and any disruption in trade flows could harm foreign economies as well. Additionally, U.S. exporters may lose credibility as reliable suppliers, leading to long-term damage to trade relationships. Countries may seek out alternative markets, reducing the U.S.’s competitive edge in global trade.

6. Political Pressure and Government Intervention

When a dockworkers strike occurs, it often triggers political pressure from businesses, industries, and consumers for government intervention. The U.S. government has the legal authority, under the Taft-Hartley Act, to intervene in certain labor disputes that could jeopardize the national economy. During the 2002 West Coast dock strike, the federal government stepped in to force dockworkers back to work, citing the economic damage caused by the stoppage.

Government intervention, however, is not always an ideal solution. Forced resolutions can lead to longer-term tensions between workers and employers, potentially creating further unrest down the line.

Conclusion

A dockworkers strike can have profound implications for the U.S. economy, affecting supply chains, consumer prices, local economies, national GDP, and global trade relations. While short-term strikes may result in temporary disruptions, prolonged disputes can lead to significant economic damage. As the U.S. remains a crucial player in global trade, the efficient operation of its ports is essential to maintaining economic stability. Ensuring fair labor practices, addressing concerns over automation, and promoting collaborative negotiations between labor unions and employers are essential to preventing future disruptions in this vital sector.