New Podcast Episode: Factoring – A Funding Source for Start-ups.

Questions about what you’ve heard? Contact Chris Lehnes | 203-664-1535 | clehnes@chrislehnes.com | www.chrislehnes.com

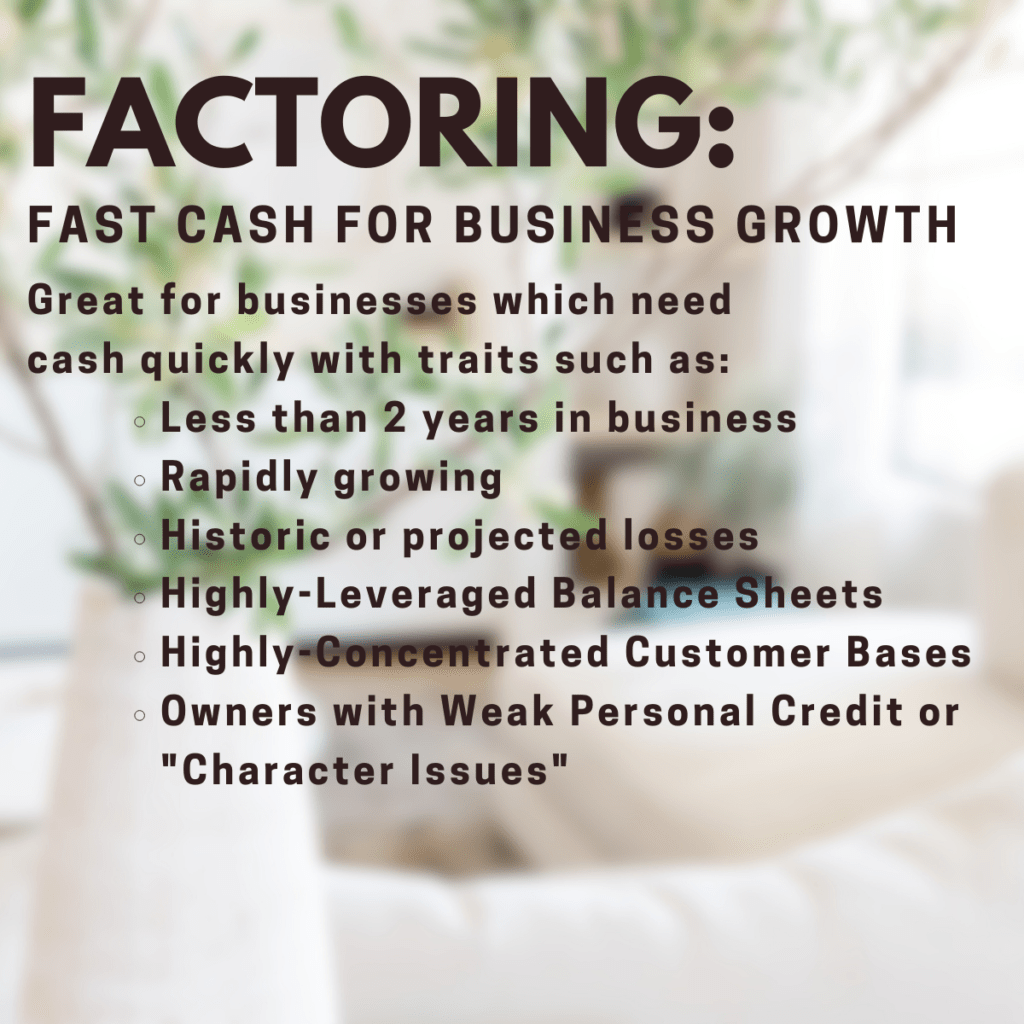

Key Concepts Review Factoring: A financial transaction where a business sells its accounts receivable (invoices) to a third party (a factor) at a discount to receive immediate cash. Accounts Receivable: Money owed to a company by its customers for goods or services provided on credit. Working Capital: The capital available to a company for day-to-day operations. Calculated as current assets minus current liabilities. Start-ups: A new business venture, typically characterized by high uncertainty and rapid growth potential. Invoice: A commercial document that itemizes and records a transaction between a buyer and a seller. Glossary of Key Terms Accounts Receivable: Money owed to a company by its customers for goods or services provided on credit. Represented by invoices. Factoring: A financial transaction where a business sells its accounts receivable (invoices) to a third party (a factor) at a discount to receive immediate cash. The factor takes on the responsibility of collecting payment from the customer. Invoice: A commercial document that itemizes and records a transaction between a buyer and a seller. It specifies the goods or services provided, the quantity, the agreed-upon price, and payment terms. Startup: A new business venture, typically characterized by high uncertainty and rapid growth potential. Often faces challenges in securing traditional financing due to a limited track record. Working Capital: The capital available to a company for day-to-day operations. Calculated as current assets minus current liabilities. Adequate working capital is essential for a business to meet its short-term obligations and fund its growth. Business Development Officer: A professional who focuses on generating new leads, nurturing relationships with prospective clients, and promoting business growth. Startups are often overlooked for traditional financing: Lehnes directly addresses the common misconception that startups are not suitable candidates for factoring. He states, “a lot of people don’t consider [startups] as a potential candidate for factoring.” This highlights a gap in financing options for new businesses that might not qualify for conventional loans. Factoring provides immediate working capital: The core benefit of factoring is the immediate cash flow it provides. Lehnes explains, “what our client gets is immediate access to the working capital to build this client relationship, hopefully bring on new clients and become a much stronger business.” This allows startups to cover expenses like payroll and supplier costs, supporting operations and growth. Example Scenario: Seafood Startup: Lehnes presents a specific example of a seafood startup that wants to fulfill a large order from a grocery store chain with 30-day payment terms. Factoring allows the startup to accept the order by bridging the cash flow gap between delivery and payment. “Our client makes a delivery to this customer, invoices, we factor the invoice, purchase it, advance them 75% of the cash immediately, and they can use that cash to pay their employees, pay their suppliers, and keep the wheels in motion.” Focus on Customer Creditworthiness: Versant Funding prioritizes the financial stability of the start-up’s customers over the startup’s own history. As Lehnes emphasizes, “we will do a deal for a company that’s brand new… for us, what’s important is that that one customer be strong.” This is a crucial distinction, as it opens up financing opportunities for startups with strong customer relationships. Cost of Factoring: Lehnes mentions a typical factoring fee of approximately 2.5% per month. He states, “…taking out a fee which in a case like this is usually about 2 and a half % per month.” While this is a cost to the startup, it is presented as worthwhile for the access to immediate capital and growth opportunities. Important Facts/Details: Advance Rate: Versant Funding typically advances 75% of the invoice amount upfront. Fee Structure: The factoring fee is around 2.5% per month. Versant Funding’s Target Client: Start-ups with creditworthy customers, even those with limited operating history. Quotes for Emphasis: “Start-ups are welcome.” “what our client gets is immediate access to the working capital” “for us what’s important is that that one customer be strong” factoring as a valuable financial tool for startups that are seeking to grow but may be excluded from traditional lending options. By focusing on the creditworthiness of the startup’s customers, Versant Funding can provide much-needed working capital, enabling startups to fulfill large orders and expand their businesses. The 2.5% monthly fee is framed as a worthwhile investment for the benefits of immediate cash flow and accelerated growth.

Contact Factoring Specialist, Chris Lehnes – 203-664-1535 | clehnes@chrislehnes.com